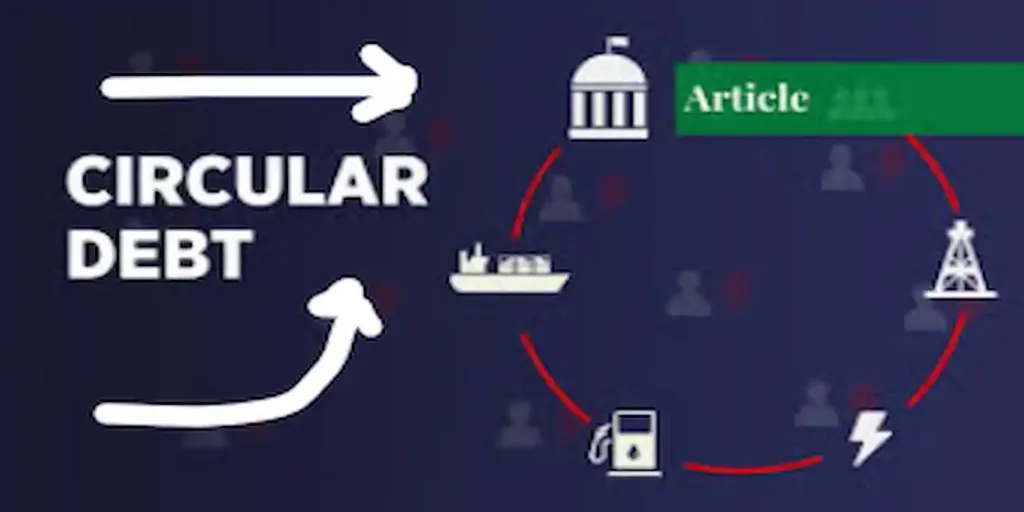

Circular debt, a complicated problem defined by a loop of unpaid payments and financial dues inside the power industry.

A growing cyclical circular debt issue is plaguing Pakistan’s energy industry, endangering the nation’s fiscal health, energy security, and economic stability.

One of the most urgent structural issues facing the government is the circular debt in Pakistan’s electricity industry, which is estimated to have exceeded PKR 2.7 trillion by 2025.

However, what is circular debt, how did Pakistan get up in this situation, and what steps are necessary to end this cycle?

Circular debt: what is it?

The chain of unpaid invoices that builds up across the energy supply chain as a result of inefficiency and late payments is known as “circular debt” in the power industry.

- Due to inefficiencies and losses, Power Distribution Companies (DISCOs) are unable to collect full payments from customers.

- DISCOs are unable to compensate Independent Power Producers (IPPs) in full.

- Consequently, IPPs are unable to reimburse fuel providers, such as Pakistan State Oil (PSO).

- PSO is unable to pay foreign suppliers and refineries.

A vicious cycle of unpaid debts is created, which impairs cash flow and damages electricity distribution and generation, resulting in load shedding and system inefficiencies.

How Did the Circular Debt in Pakistan Get Here?

Systemic inefficiencies, political choices, and economic pressures have all contributed to the development of the cyclical debt issue for more than ten years:

- High Transmission and Distribution (T&D) Losses: Non-recovery of invoiced money is a result of both technical malfunctions and electrical theft.

- Subsidized pricing: The recovery of actual generation costs is impeded by political pressure to maintain artificially low power pricing.

- Delayed Tariff Adjustments: Growing payment gaps are the result of slow procedures for modifying tariffs to reflect increases in gasoline prices.

- Capacity Payments: Regardless of power offtake, Pakistan’s energy contracts mandate fixed payments to IPPs, which increases debt when demand declines.

- Currency depreciation: This puts further strain on the industry by raising the price of imported gasoline.

Effects on Pakistan's Energy Security and Economy

The ramifications of the cyclic debt issue are extensive:

- Load-Shedding: When electricity producers are short on liquidity, they cut back on output, which causes power disruptions that impact homes, companies, and industries.

- Pressure on Fiscal Space: The government regularly injects money to pay off circular debt, which pushes out development investment and widens the fiscal imbalance.

- Investor Confidence: Growing circular debt deters capital from entering the electricity industry, postponing vital infrastructure improvements.

- Rising Energy Prices: Consumers are burdened by abrupt price increases that frequently result from delayed changes.

- Effect on PSO: Fuel supply networks may be disrupted by cash flow issues on PSO brought on by past-due payments, which might lead to wider economic instability.

The Government's Circular Debt Management Initiatives

Pakistan’s cyclical debt situation has been addressed by several governments, but long-term fixes have been thwarted by structural problems.

Among the main actions taken are:

- Tariff changes to lessen the impact of subsidies.

- Campaigns against theft in high-loss zones. Increasing the effectiveness of billing and collection.

- Making the switch to renewable energy will lessen reliance on petroleum imports.

- % Reforms to the power sector under IMF programs, with an emphasis on quick tariff changes and loss reduction.

Circular debt has increased in spite of these initiatives, underscoring the necessity of a long-term, comprehensive strategy as opposed to short-term financial boosts.

The Way Ahead: Ending the Pattern

Pakistan must prioritize structural and governance reforms in order to address the cyclic debt dilemma in a sustainable manner.

These reforms include:

- Cutting T&D losses by modernizing the grid and enforcing anti-theft laws.

- Cost-reflective tariffs are being implemented, and targeted subsidies are being used to protect low-income customers.

- To lower capacity payments, costly power purchase agreements (PPAs) should be renegotiated with IPPs.

- Increasing the use of renewable energy to reduce reliance on imported fuels and total generation costs.

- To guarantee improved billing and collections, DISCOs should improve their governance and transparency.

- Campaigns for energy saving and public awareness to cut down on waste.

Why It's Important Now

Since Pakistan is struggling financially and is looking to the IMF for assistance, resolving circular debt is essential to keeping the economy stable.

Because of fuel imports, the inefficiencies in the energy sector have a direct effect on inflation, industrial productivity, and foreign exchange reserves.

Reducing cyclical debt is important for Pakistan’s public welfare, sustainable growth, and economic stability, not only the energy industry.

Concluding remarks

Pakistan’s circular debt dilemma is a sign of more serious structural inefficiencies in the electricity industry, which calls for immediate and ongoing change. Circular debt would keep depleting the economy, impeding investment, and making Pakistan susceptible to energy crises unless immediate action is taken.

Pakistan may start to escape the cycle of circular debt by emphasizing openness, effective energy pricing, and a shift to sustainable energy sources. This will open the door to a resilient economy and a stable energy future.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin