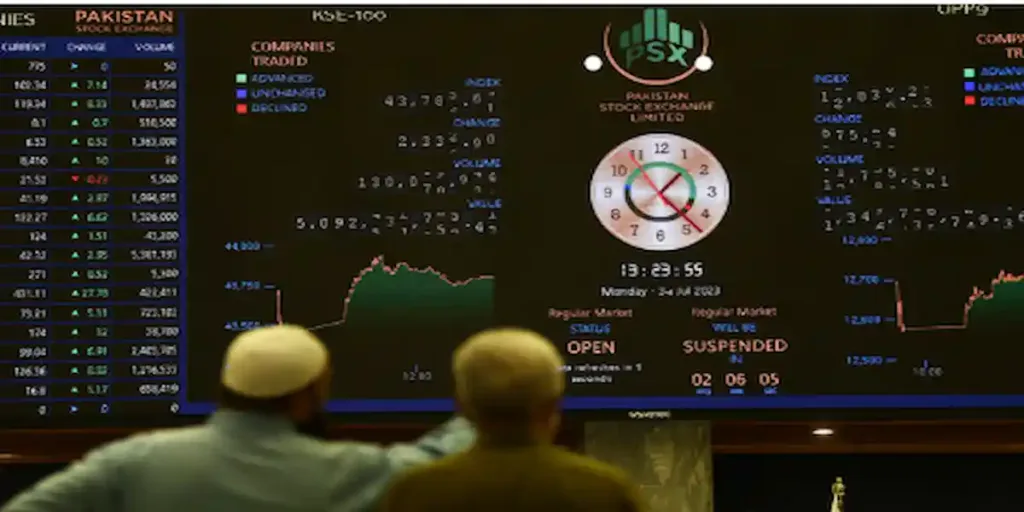

Amid solid economic signs, record remittances, and expectations of high corporate profitability, investor confidence roared back at the Pakistan Stock Exchange (PSX) on Thursday, as the benchmark KSE-100 index gained 1,205 points, ending at a new all-time high.

As Pakistan’s macroeconomic fundamentals continue to recover, the market’s resilience and investor optimism are demonstrated by the rally that follows a minor pullback in the previous session.

Market Summary: Record High During Powerful Flows

The KSE-100 index increased 1,205.36 points (+0.91%) throughout the session, closing at 133,782.35 points.

The index saw significant purchasing activity throughout the trading day, reaching an intra-day high of 133,902 and a low of 132,706.

MD of Arif Habib Corp According to Ahsan Mehanti, the rise was supported by anticipation about the corporate results season, which is anticipated to start well, and declining long-term government bond rates, which might indicate a possible softening of SBP policy.

Record Remittances Encourage Market Hope

The revelation that Pakistan earned its highest-ever annual inflows of home remittances, surpassing $38 billion during FY 2024-25, was a major catalyst for Thursday’s rise.

This milestone has strengthened the nation’s foreign exchange reserves, enhancing investor sentiment and economic stability. It was made possible by efficient government policies and SBP’s efforts to support formal channels.

Pakistan also announced a 4.67% rise in exports for FY25, which improved the macroeconomic picture even further.

The Banking Industry Drives the Growth

Strong demand in recent government debt auctions and the macroeconomic stability demonstrated by the nation’s foreign reserves and remittance statistics helped the banking industry emerge as the main driver of profits. MCB Bank (+2.59%), United Bank (+1.09%), and Meezan Bank (+3.17%) were the main drivers of the index’s increase.

The strong demand for government bonds and growing fiscal stability are fostering an atmosphere that is advantageous for the banking industry, which stands to gain even more as liquidity increases, according to JS Global analyst Muhammad Hasan Ather.

Performance of the Broader Market

Indicating increasing investor interest across important industries, trading volumes increased to 941.7 million shares from 905.7 million in the previous session.

Out of the 479 firms that were traded, 24 stayed the same, 195 fell, and 260 finished higher. A total of Rs36.1 billion worth of shares were exchanged. One of the biggest winners was Kohat Cement, which saw an 8.5% increase after being granted permission to establish Ultra Properties as a wholly-owned subsidiary for real estate and rental activities. In anticipation of the company’s earnings, Nishat Mills Limited (NML) also received a lot of purchasing activity; Topline Securities kept its “buy” rating and its June 2026 target price at Rs225.

Among the session’s major losses were Pakistan Services (-5.34%), Oil and Gas Development Company (-0.61%), and Pakistan State Oil (-1%).

Activity of Foreign Investment

According to the National Clearing Company of Pakistan Limited (NCCPL), foreign investors continued to be net sellers, unloading shares valued at Rs324 million despite the positive momentum.

Strong local involvement, however, countered the international withdrawals and kept the market moving upward.

Crucial Levels to Monitor

As of Friday’s session, the market is targeting the 134,100 level as the next resistance level after holding its support zone of 132,000–133,000 throughout the week, according to Arif Habib Limited (AHL).

According to analysts, the Pakistan Stock Exchange (PSX) may continue on its upward trajectory in the near future if the index consolidates above the 130,000 level with rising volumes and widespread participation, particularly if corporate profits live up to expectations.

A More Comprehensive Economic Framework

The timing of Pakistan’s improving economic signals is crucial, as the government works to stabilize the economy by:

- Increased inflows of remittances.

- Growth in exports.

- Initiatives to draw in international capital.

- The IMF framework supports macro-fiscal discipline.

Stable foreign exchange reserves and declining inflation have made opportunity for the SBP to possibly lower policy rates, which would further boost equities markets by lowering borrowing costs for individuals and companies.

Concluding remarks

The Pakistan Stock Exchange (PSX’s) 1,205-point spike shows how resilient and upbeat Pakistan’s financial markets are, propelled by record remittances, robust exports, and expectations of policy easing in the face of declining bond rates.

Investors will keep a careful eye on business performance, fiscal policies, and the SBP’s monetary policy as earnings season gets underway in order to determine if this positive trend will continue.

For investors looking for stability and development in one of Asia’s most vibrant emerging markets, the Pakistan Stock Exchange (PSX) record high for the time being indicates a restored sense of confidence in Pakistan’s economic trajectory.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Litecoin

Litecoin